虽然美国股市在很大程度上从锋利的第一季度抛售了,但它仍然不确定,因为Covid-19危机继续展开的经济影响,这可能会导致。邀请组合管理人员斯科特沃尔斯(悉让),首席投资官,全球资产分配和多态资产负责人,探讨了当前的投资气候,并向多资产风险缓解战略提供见解,以帮助优化产品组合结果潜力。

你看到机构投资者带走了大流行的教训?亚博赞助欧冠

大卫米尔:From an investment perspective the crisis has served as a reminder about the need to be prepared for a broad range of investment scenarios – both good and bad. How long the pandemic might last and its longer-term economic effects remain difficult to predict. However, we have seen that investors overexposed to risk when it began, as well as those who may have played it overly cautious when markets began to rebound, were likely to have suffered more disappointing relative portfolio performance than those that maintained more optimized risk/reward exposures.

好消息是,投资者今天可以利用广泛的策略来帮助更好地通过增加较低和非相关资产来更好地多样化传统资产类别分配。这些类型的策略可以通过帮助加强整体防御性来增加有意义的投资组合价值和upside characteristics.

Scott Wolle:危机还强调了维持流动性的重要性。所有类型的风险资产在大流行的开始时经历了急剧的畅销。为了浏览这种类型的极端动荡,投资者必须知道他们可以在他们的投资组合中转向流动性,特别是当一切似乎正在下降时,这是重要的。

Highly liquid multi-asset solutions are designed to offer an attractive choice in this type of climate. These strategies often pursue steadier return streams with an attractive upside beyond that traditionally available from most fixed income securities – and without the drawdown exposures of equity markets. This can help provide an expanded range of investment levers to help optimize expected return consistency through all types of investment cycles.

How can multi-asset strategies work for risk mitigation?

Millar:多资产策略旨在提供灵活性,允许从特定的市场驱动性能转移到更绝对的返回和其他导向的解决方案,以便更加控制风险暴露。这些策略的主要优势是,与对冲基金,私募股权和风险投资等策略相比,他们寻求提高潜在的投资组合风险效率,更具流动性,透明度和成本效率。

这些策略尝试塑造风险暴露的一些不同方式是什么?

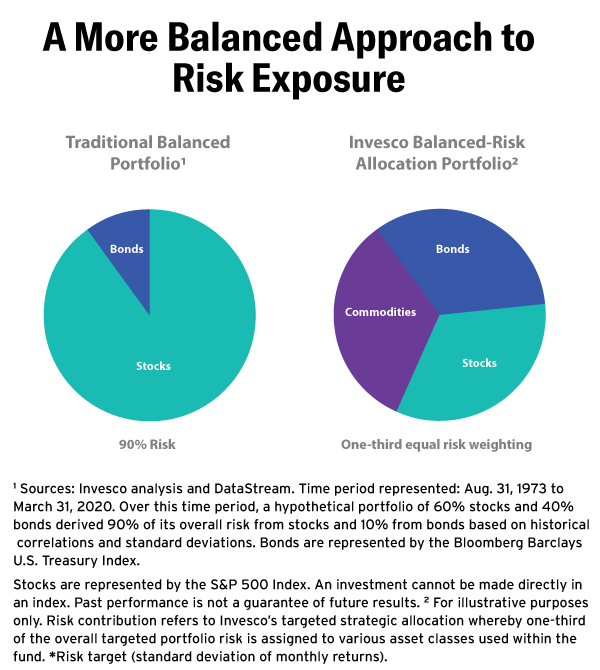

Wolle:In terms of risk mitigation, let’s start with risk parity, where allocations are based on volatility contribution rather than capital exposures. In a traditional 60/40 portfolio, history shows up to 90% of risk is generated by the equity allocation, which isn’t balanced at all. By contrast, our Balanced-Risk Allocation strategy optimizes allocations across equity, fixed income, and commodity market exposures. It does so through up to 30+ sub-asset classes, and is based on each asset class contributing an equal amount to overall risk. A slight tactical overlay then seeks to help take advantage of current market conditions. The goal is to deliver more consistent returns across the full economic cycle, with less risk than a traditional 60/40 allocation. While returns will still be linked to these underlying markets, the strategy’s balanced risk approach has generated lower correlations of 0.73 and 0.491自成立以来,分别为全球股票和美国固定收入市场2.

How can absolute return strategies work in today’s market environment?

Wolle:Absolute return approaches can vary widely in terms of philosophy and execution, offering investors a broad selection to help meet their specific needs and goals. For example, the Invesco Macro Allocation strategy is differentiated by its systematic use of risk premia exposures rather than alpha potential for allocation decisions. It utilizes some of the same tools as our Balanced-Risk Allocation strategy, starting with a risk-balanced core, but significantly dials up the tactical overlay to be the primary return driver by using directional and relative volatility trends. It also invests in long and short positions, which provides greater flexibility to pursue absolute returns independent from broader capital market indices. The result has been a unique risk/reward profile that historically has delivered consistently positive returns over longer timeframes, largely uncorrelated with assets traditionally associated with attractive defensive attributes in difficult markets.

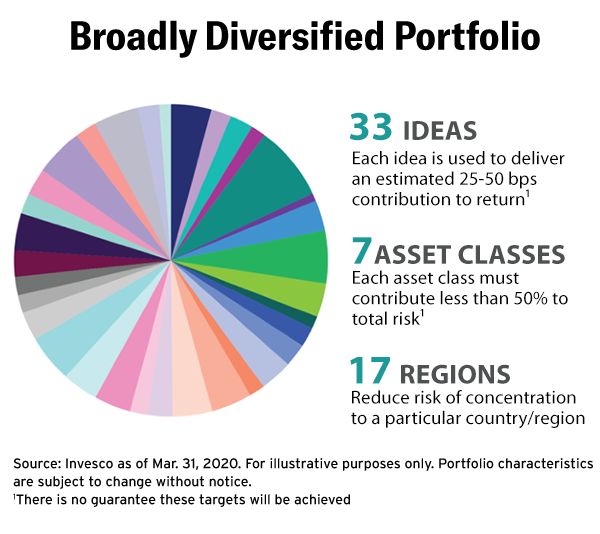

Millar:我们的全球目标退货策略采用了不同的方法,通过思想驱动的组合从传统的资产分配模型中断。该战略与风险建模相结合了广泛的研究,将多达30名通过在全球资产,地理位置,行业和货币中进行搜索的投资思路混合在一起。这些想法可以使用信贷和政府证券,股票,商品和货币以及其他曝光,如通货膨胀,利率,波动和相对价值对交易。

一个想法与短的智慧比索的位置配对了一个漫长的俄罗斯卢布位置。投资组合受益于更便宜,更高携带卢布加强了比索,因为双盈俄罗斯经济比双赤字智利经济更好。这种类型的钻取以寻找引人注目的想法可以从资产类别内追求收益 - 在这种情况下,新兴市场 - 没有依赖更广阔的市场本身的总体方向。

每个选择的想法是基于其潜在的广告d independent, positive returns over a two- to three-year time horizon. Relative size is based on return potential and expected volatility under various economic scenarios, both in isolation and in relation to other ideas. The goal is to deliver a consistent, positive hit ratio across the majority of ideas, with no single idea or risk exposure dominating performance. Achievement of that goal is seen in broadly diversifying return streams that positively skew monthly returns while significantly lowering equity beta exposure and avoiding extreme drawdowns.

How are institutional investors incorporating these types of strategies into their portfolios?

Wolle:这取决于战略及其特征,以及投资者的目标和投资指南。平衡风险分配策略通常被用作传统的60/40个投资组合分配的更具风险效率的选择或补充。宏分配通常被放置在多资产或液体替代品套管内或对冲基金补充或更换,因为其过度的回报焦点,费用相对较低,日常流动性,日常定价和缺乏锁定。

Millar:Global Targeted Returns is frequently placed in a global tactical asset allocation or opportunistic sleeve, typically with other liquid alternatives or hedge fund investments. One of the unique characteristics within the multi-asset space is that in addition to having lower correlations to traditional assets, these strategies also often exhibit lower correlations to one another due to the relatively wide range of investment styles. Because of this, investor allocations can include complementary strategies to further optimize portfolio risk/reward exposures.

Start a conversation about risk mitigation strategies. Learn more.

1截至2020年4月30日。

2 June 2, 2009.

This document is intended only for institutional investors in the U.S. It is not intended for and should not be distributed to, or relied upon, by the public. This is for informational purposes only, is not to be construed as an offer to buy or sell any financial instruments, and should not be relied upon as the sole factor in an investment-making decision. This document contains general information only and does not take into account individual objectives, taxation position or financial needs. This does not constitute a recommendation of any investment strategy for a particular investor. As with all investments, there are associated inherent risks. Investors should consult a financial professional before making any investment decisions if they are uncertain whether an investment is suitable for them. The opinions expressed herein are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals. All data as of April 30, 2020, unless stated otherwise.

Invesco Advisers,Inc。是一名提供投资咨询服务的投资顾问,不销售证券。NA7064.