Blu Putnam and Erik Norland, CME Group

AT A GLANCE

- Commodities supercycles of the 1970s and 1990s had major economic and monetary drivers, but it’s unclear if such a driver exists today

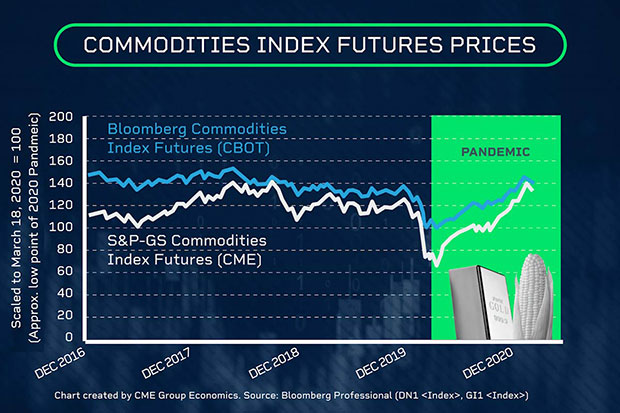

- The Bloomberg and S&P-Goldman Sachs commodity indexes have risen sharply, though it could be years before a supercycle is realized, say CME Group economists

For a commodities rise to become a supercycle, it should meet three criteria, says Erik Norland. The trend should be broad based, meaning it should include the majority of major commodities; it should have a duration of five or more years; and finally the price rise should be “super-sized” as in a tripling or more.

By that criteria, two commodities supercycles have occurred since the end of WWII, Norland and Blu Putnam say in the latest episode ofThe Economists, which you can watch above.

- Mid 1960s through the 70s

- Mid 1990s – 2008

The 60s-70s supercycle was all about U.S. dollar depreciation after the fixed exchange-rate dollar standard system broke down. “When the dollar declined year after year during the 1970s, commodities kept on rising. This was a broad-based commodities supercycle,” says Putnam.

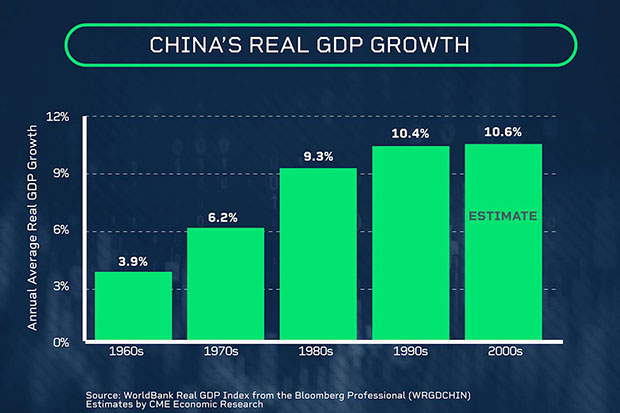

The 90s-2000s supercycle was due to China’s enormous growth and modernization.

“You just can’t modernize a country with over a billion people without consuming massive quantities of industrial metals such as copper and energy commodities such as oil,” Norland says.

That’s the history. But where do we sit now? Commodity price increases in 2021 could be showing the early stages of a new commodities supercycle. Both the Bloomberg and S&P-Goldman Sachs commodity indexes have seen sharp increases in 2021, rising 17% and 26%, respectively at the beginning of May.

If we do see a supercycle, it won’t be for the same reasons as the last two, Norland and Putnam say.

“I would argue it won’t be anything like the last two supercycles,” says Norland. “Demographic headwinds are going to be severe for China heading into the 2020s. And with an aging population, declines in the labor force are highly likely.”

Says Putnam, “Sure, the U.S. dollar may have bouts of weakness, but the sustained declines of the 1970s are not as probable given the consistency and synchronization of monetary policy stances among mature industrialized countries.”

There are a few possibilities for what might drive the next supercycle, they say in the above video. But fundamentally there is one constant in every supercycle.

“The important takeaway is that commodities supercycles require an outsized driver. We also note that supercycles, like asset price bubbles, are best recognized in the rearview mirror,” says Putnam.

The Economists is a video series covering the industries and events shaping global economics with a special focus on post-pandemic economic realities. Episodes are released monthly.

Read more articles like this at OpenMarkets